The IRS defines a charitable contribution as a “donation or gift to, or for the use of, a qualified organization.” A charitable contribution must be made voluntarily without an expectation of receiving anything

taxes

- You're Here

- Home Tag: taxes

The IRS offers group exemptions whereby a central organization’s federal tax exemption will apply to its subordinates and obviate any need of the subordinates to separately apply for exemption. Rather than each organization

An Employer Identification Number (EIN) is a type of Tax Identification Number (TIN). There are many kinds of TINs, including Social Security Numbers (SSNs). An EIN is like a SSN but is used

Besides directing what happens to your finances when you pass away, a comprehensive estate plan also addresses the possibility that you could become unable to handle your financial affairs while you are still

“Tax basis” is a term used frequently in tax law. But for many, the term is unfamiliar and intimidating—perhaps something they feel is better left to a certified public accountant to worry about.

Whether you’re a small LLC, an Electing Large Partnership LLC or an S-Corporation, March 15th marks the date you must file your 2019 tax returns (Form 1065, 1065-B, 1120S, or 2553, depending upon

It’s that time of year again: tax season. No one enjoys doing their taxes, and that is likely why many of us leave this tedious task to the last…possible…moment. As Tax Day approaches,

In our last blog, we discussed the limitations of a Tax-Deferred Exchange – a technique available to defer taxes and maximize the funds available for reinvestment upon the sale of an investment property.

A big question we get is how long should you maintain tax returns and supporting documentation? As the year ends and you prepare for your 2016 tax return, here is some good advice

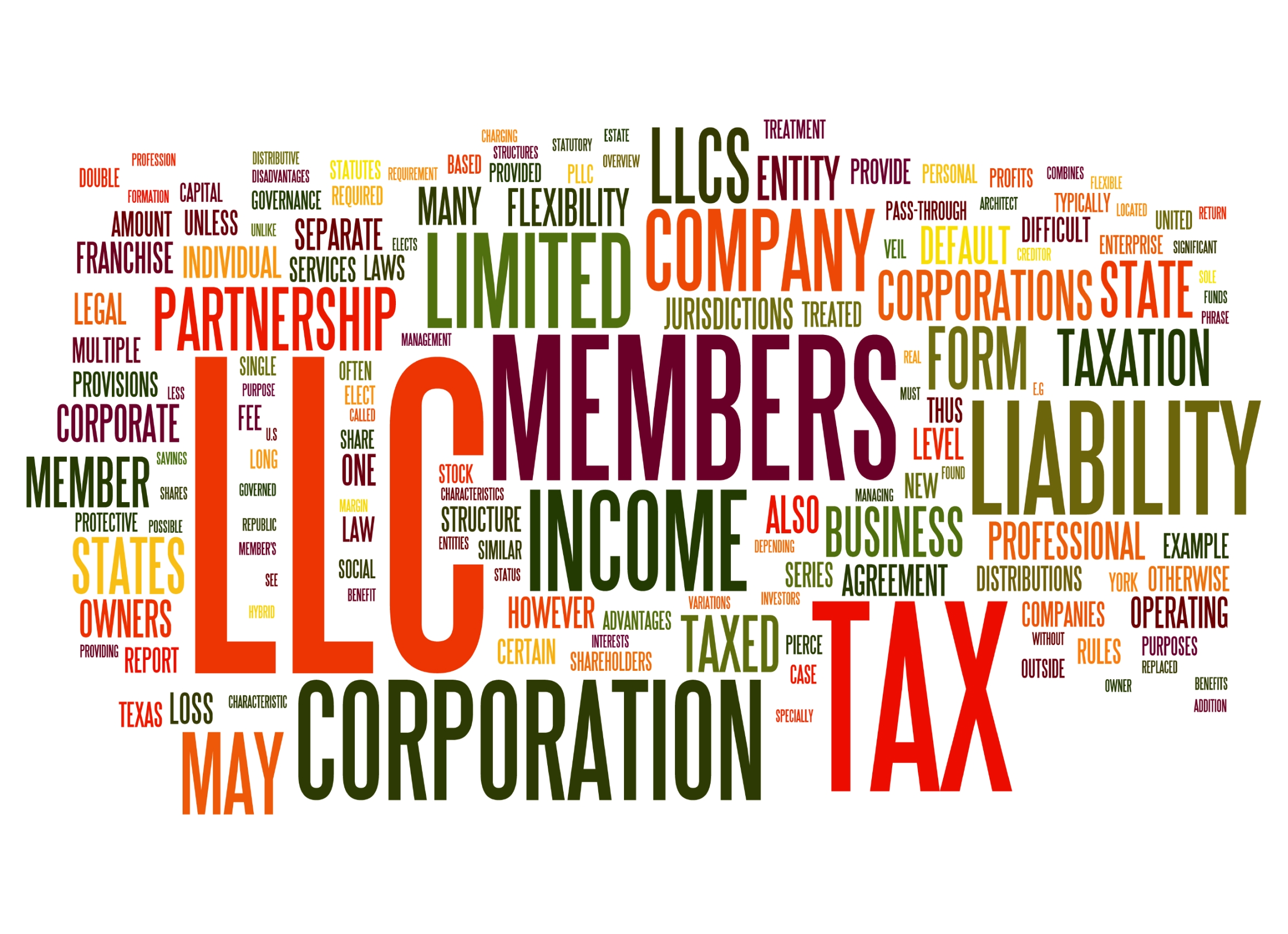

1. What is a Limited Liability Company? A limited liability company or “LLC” is a business entity that is designed to offer co-owners of a business who make a proper filing with the

- 1

- 2

Our Practice Areas Include:

Blog Categories

Recent Blog Posts

Address

© Davis Law Group | Privacy Policy | Disclaimer | Website creation & maintenance by Bull & Company MediaWorks